For A Service Business, Which Of The Following Would Not Be A Line Item On The Income Statement?

What is Sales Revenue?

Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms "sales" and "revenue" can be, and often are, used interchangeably to mean the same thing. It is important to note that revenue does not necessarily mean cash received. A portion of sales revenue may be paid in cash and a portion may be paid on credit, through such means as accounts receivables.

Sales revenue can be listed on the income statement Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or as either the gross revenue amount or net revenue. Net revenue includes all deductions for the return of goods, the possibility of undeliverable merchandise and the expense for unrecoverable accounts receivables (also known as "bad debt expense", which flows into the balance sheet as the allowance for doubtful accounts). Gross revenue, on the other hand, does not include these deductions. The gross revenue presentation will have the deductions listed below gross revenue, and a subtotal for net revenue below that.

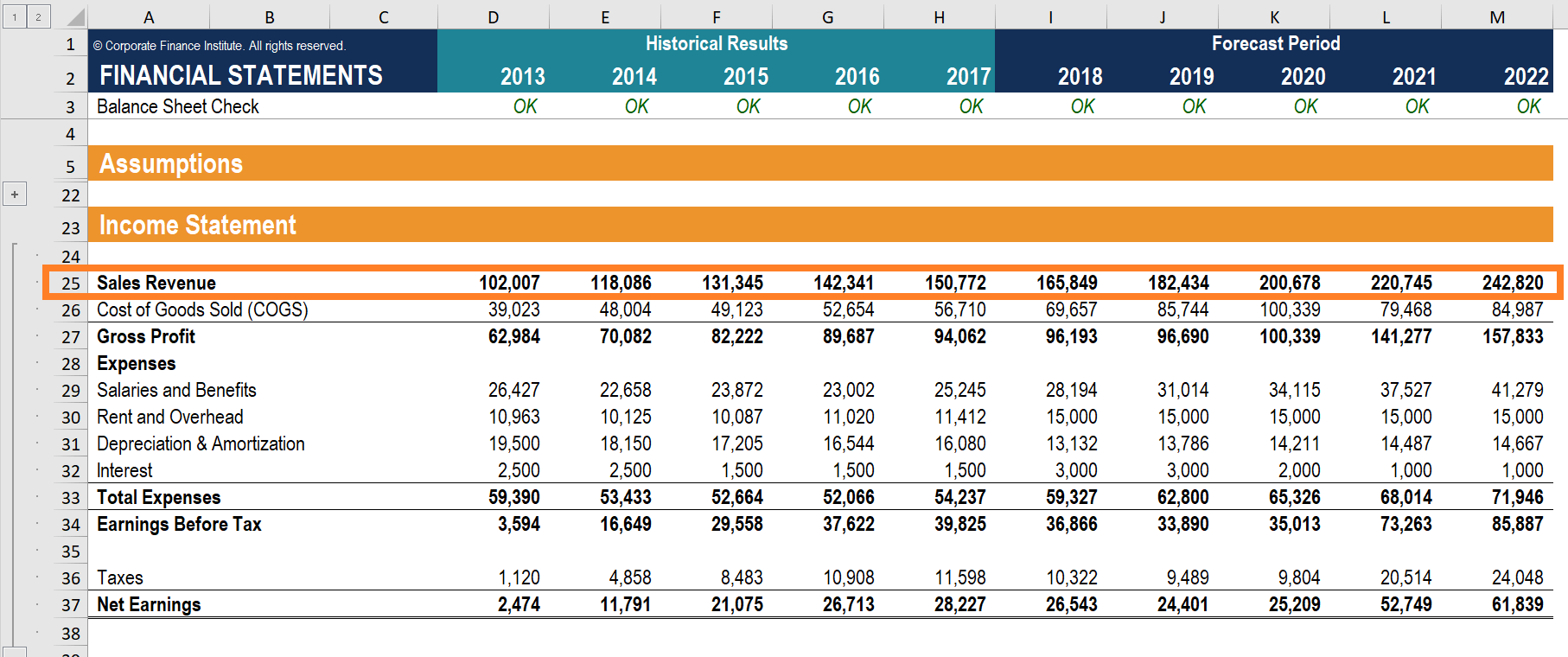

Sales Revenue and the Income Statement

The very first line of the income statement is sales revenue. This is important for two reasons. First, it marks the starting point for arriving at net income. From revenue, cost of goods sold is deducted to find gross profit. Depreciation and SG&A expenses are deducted from gross profit to find the operating margin, also known as EBIT. EBIT less interest expense is pre-tax income, and pre-tax income minus taxes is net income.

Secondly, as the first item on the income statement, sales revenue is an important line item in the top-down approach of forecasting the income statement. The historic trend of revenue is analyzed, and revenue for future periods is forecasted. All expenses below sales revenue are often found expressed as a percentage of that revenue. As the first item listed on a financial statement Analysis of Financial Statements How to perform Analysis of Financial Statements. This guide will teach you to perform financial statement analysis of the income statement, , it becomes the pivot or anchor from which other line items are proportional to. This is also one of the reasons why sales revenue is known as the "top line".

Sales Revenue Example

Below is an example from Amazon's 2017 annual report ( 10-k ) which shows a breakdown of its sales according to products and services. In 2017, Amazon had net sales of $119 billion from products and $59 billion from services, for a combined total of $178 billion. As you can see, this forms the top of the income statement, and all expenses and profits or losses are located below that level in the report.

Additional Resources

CFI offers the Financial Modeling & Valuation Analyst (FMVA) Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! ® Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! certification program for those looking to take their careers to the next level. To help you advance your career, check out the additional CFI resources below:

- Income Statement Template

- Forecasting an Income Statement Projecting Income Statement Line Items We discuss the different methods of projecting income statement line items. Projecting income statement line items begins with sales revenue, then cost

- Revenue Run Rate Revenue Run Rate Revenue Run Rate is an indicator of financial performance that takes a company's current revenue in a certain period (a week, month, quarter, etc.) and converts it to an annual figure get the full-year equivalent. This metric is often used by rapidly growing companies, as data that's even a few months old can understate the current size of the company. guide, example, formula

- Financial Modeling Guide Free Financial Modeling Guide This financial modeling guide covers Excel tips and best practices on assumptions, drivers, forecasting, linking the three statements, DCF analysis, more

For A Service Business, Which Of The Following Would Not Be A Line Item On The Income Statement?

Source: https://corporatefinanceinstitute.com/resources/knowledge/accounting/sales-revenue/

Posted by: ingramwittleasto.blogspot.com

0 Response to "For A Service Business, Which Of The Following Would Not Be A Line Item On The Income Statement?"

Post a Comment